By: Alinda Ronnie Kyamureku

Introduction

Knowing which type of bank account to own is very important to managing your finances. Uganda has 25 licensed commercial banks, with each offering a variety of account types to cater to the diverse needs of individuals and businesses. Whether you are a student, a young professional, a parent, or a business owner, there is a bank account designed to meet your specific requirements. In this article, we will explore the common types of bank accounts offered by banks in Uganda, their features, and benefits, and how to choose the best one for your needs.

Why Do You Need a Bank Account?

Contrary to popular belief that bank accounts are only for those who are above a certain income class, banking is an essential service that provides several benefits to account holders. So, before we detail the different account types, let us remind ourselves why it is important to have a bank account.

❖ Secure custody: The most important reason for having a bank account is safe custody. Bank accounts provide a safe place to store your money, reducing the risk of theft or loss compared to keeping money at home, in the shop, or with trusted friends or relatives.

❖ Convenient and safe transactions: A bank account provides you with an easy channel through which to easily make payments, receive salaries, and transfer funds electronically. This eliminates the disadvantages of transacting with physical cash like inaccuracies in counting money, bulky amounts of money that require transportation with the attached risks, old or torn notes exchanged, or even losses from accepting fake notes.

❖ Interest earnings: Many bank accounts offer interest on your balance, especially for savings accounts, which helps your money grow over time.

❖ Financial planning: Bank statements and online banking tools can assist you in managing your finances and tracking transactions. This would be difficult for transactions in cash and storage by other means. Most banks also provide support services like business advisory to their clients, which offers an added advantage over those without accounts.

❖ Eligibility to participate in financial markets: Bank accounts make you eligible to participate in financial markets actively. When you have a bank account, you qualify to apply for loans and invest in other financial instruments like government treasury bills and bonds.

Types of Bank Accounts in Uganda

As the banking sector has developed in Uganda, the variety of bank products has increased. They may offer slightly differentiated services and fees, but they can all be broadly placed under the following categories:

❖ Savings Account: Ideal for individuals looking to save money over time, savings accounts offer interest on deposits. However, they sometimes come with requirements like maintaining a minimum balance to open and run this account, or limits on the amount and number of withdrawals in a particular month to encourage saving. It would be recommended for those who do not earn a regular income to cultivate a saving culture.

❖ Current Account: Also known as a checking account in certain countries, a current account is designed for everyday transactions. It allows you to write cheques, make ATM withdrawals, make point-of-sale payments, and international transfers, and has a host of other services available, especially using digital channels to help access your funds easily. Current accounts are usually preferred by salary earners to receive and spend their salary.

❖ Fixed Deposit Account: Fixed deposit accounts offer higher interest rates than savings accounts and sometimes have a fixed period for which the account will hold. They impose stricter requirements on the withdrawal of funds during the designated period, making them an excellent choice for long-term savers. They are often used as an investment option by high net worth individuals since banks can negotiate higher interest rates for deposits above a certain amount.

❖ Business Account: To cater to business owners, tailored for businesses of all sizes, business accounts come with features like overdraft facilities, multiple free withdrawals per month, multiple signatories, sometimes special exchange and money transfer rates, and access to business loans.

❖ Student Account: These have the basic features of savings accounts but are designed specifically for students. These accounts often have lower fees and minimum balance requirements. They are suitable for managing limited finances during your academic years.

❖ Children’s Savings Account: These are also basically savings accounts designed to teach children the importance of saving. Children’s accounts encourage financial literacy from an early age.

❖ Salary Account: Salary accounts in most banks are designed like current accounts but have features like zero balance requirements and overdraft facilities to encourage demand. Employers often use salary accounts to pay their employees.

❖ Joint Account: Joint accounts have the features of current accounts but are shared by two or more individuals, making them suitable for couples, business partners, or family members.

It is essential to compare these account types before opening a bank account to find the right fit for your financial needs.

Features and Benefits

After understanding the basic types of bank accounts and selecting which one meets your individual or company needs, it is important to research widely about the various products and services that several banks offer. Within each account type, banks have added unique features and benefits to cater to different customer needs such as preferential interest rates, reduced fees, and dedicated account managers. Notably, several account products are available in major foreign currencies to ease cross-border payments. Furthermore, banks have started cross-selling products that may be of benefit to individuals, a business, or families, like insurance products and financial literacy and business training for small businesses.

Choosing the Best Account for You

Selecting the right bank account depends on your individual or company circumstances. Consider factors such as your financial goals, transaction needs, and the fees associated with the account. Additionally, some accounts are tailored for specific purposes, like student accounts or salary accounts. Evaluate your requirements and match them with the account type that best suits you.

Opening a Bank Account

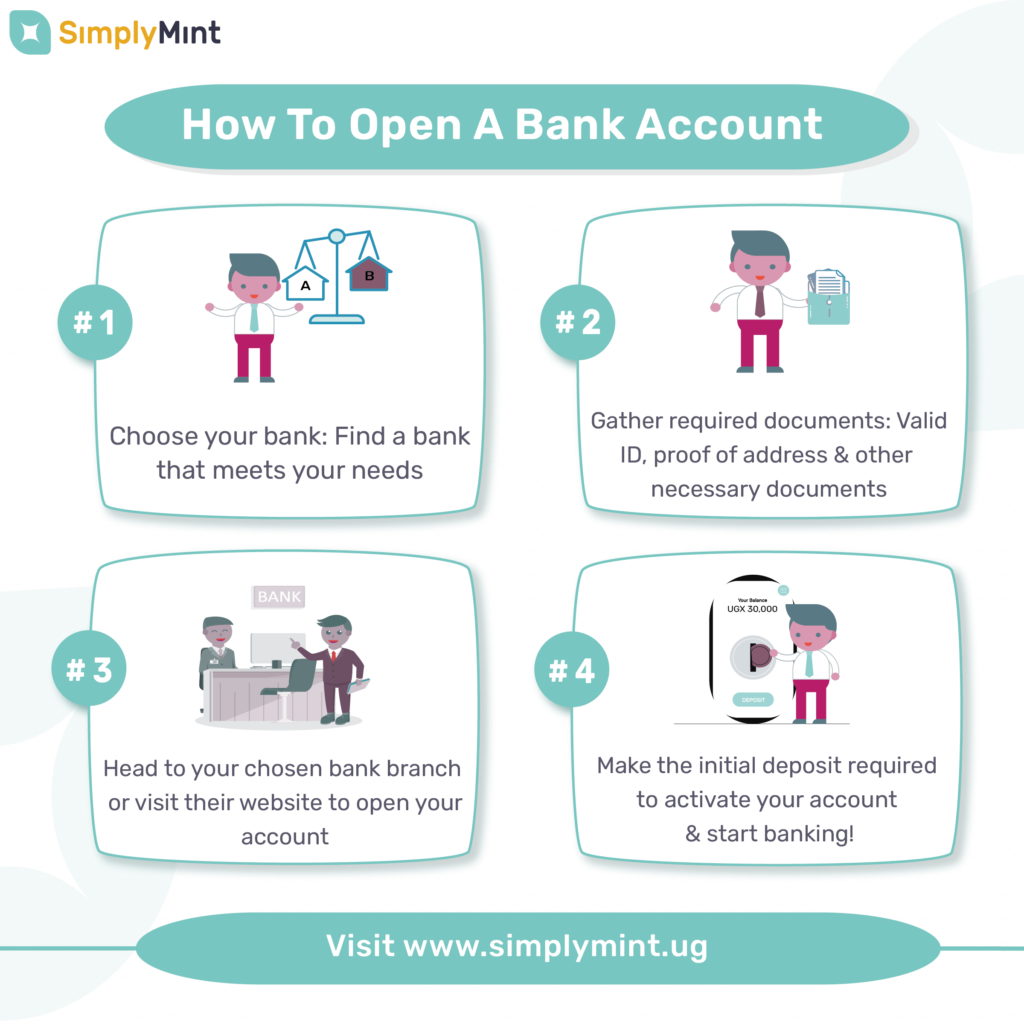

Opening a bank account in Uganda depends on the type of bank account you want to open. For personal accounts, you will typically need to provide identification documents, usually a national identity card, school ID for student accounts, or an employee ID for proof of employment for a salary account. Some banks will require proof of address such as utility bill payments or a signed tenancy agreement, and all banks will only open your account after you make an initial deposit.

Business accounts come with slightly more requirements for legal documentation like certificates of incorporation and memoranda of understanding. To get details about a particular bank’s account opening requirements, visit your preferred bank branch or inquire about online account opening options.

For non-Ugandans wishing to open an account in Uganda, the requirements do not vary very significantly. You will need to provide a valid passport or national ID of the country of your citizenship, proof of address in Uganda, and two passport-sized photographs (some banks may choose to take the photos at the branch). If you are opening a salary account, it will be prudent to provide your work authorization documentation alongside a valid work ID.

Conclusion

In Uganda, banks offer a wide range of account types to cater to the diverse financial needs of individuals and businesses. Whether you are looking to save, transact, or manage your finances more effectively, there is an account designed to help you achieve your goals. Make an informed decision by comparing the features and benefits of each account type and take the first step toward securing your financial future.

To explore the specific account options and compare them side by side, visit Simply Mint’s account comparison tables. We are here to provide you with the information you need to make the best financial choices for your unique situation.